Dental treatments in the UK can be quite an adventure, especially if you need urgent work done. Limited availability, excessively long waiting lists and exuberant costs are only a few of the drawbacks that Brits face when looking to have treatments like root canal treatment, tooth extraction or something more complicated like dental implants. Having to deal with a large bill often forces patients to look for alternative solutions such as loans or payments in instalments. And let’s face it – in most dental practices in the UK, especially fixed teeth over implants would cost an arm and a leg. Still, dental payment plans can be a suitable solution for private treatments that are not available on the NHS such as implants and cosmetic dentistry.

If you’re over 60 and struggling with paying for dental treatment in the UK you’d be surprised to know that you’re not alone. According to the Oral Health Foundation, 36% of Brits have reported avoiding the dentist because they fear that they won’t be able to afford the costs for it.

The good news is that there are different dental payment plans for patients in the UK. In this article, we’ll go over the cheaper solutions for tooth loss and different options for paying for your dental treatment such as dental loans, and dental credit cards and how you can pay monthly for your dental implants even if you have bad credit.

Contents

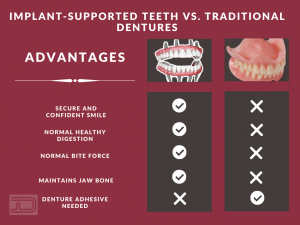

Cheaper tooth loss solutions – dental implants vs. dentures

The average prices for a full mouth dental implant treatment that you can expect to pay are as much as £14,000 – £18,000 in the UK. For toothless patients who cannot afford to get dental implants, removable dentures may be an alternative. There are different types of dentures and prices, but still, all are quite cheap and accessible, which is why most patients go for them from the start.

They can be used for both the upper and lower jaw. If you decide to go for this option, you need to get practical advice on maintenance and denture repair.

Advantages:

- They are a suitable solution for patients who can’t afford dental implants

- They can last for 5-10 years

- You can choose your shape and colour

Disadvantages:

- They can fall at any time which is why you’re always relying on adhesives to keep them in place

- In time they become less comfortable as the mouth will change its shape

- As they cover the upper palate, there could be a loss of taste in the upper jaw

- You’re prevented from enjoying your favourite foods since there is a significant chance to break or dislocate the dentures

Dental implants on the NHS

It’s important to note that no government loans are available for dental treatment done on the NHS. However, the government itself offers medically needed dental care at subsidised prices.

It’s important to note that no government loans are available for dental treatment done on the NHS. However, the government itself offers medically needed dental care at subsidised prices.

According to dentaly.org the fees for a single course of treatment are as follows:

- England: £282.80

- Wales: £203

- Scotland & Northern Ireland

Which are the cases when you can’t rely on the NHS and need to look for private practice? Those are typically cases when you can’t find an NHS dentist or the work needed isn’t covered by the NHS. The latter is divided into 3 bands depending on the complexity of the treatment and you can check them out here.

Undoubtedly the most expensive dental treatment in the UK is fixed teeth over dental implants. Most private practices offer a starting price of £2,000 per implant (some are charging even more) so it’s only natural that patients are either exploring dental implant payment plans or even considering travelling abroad to look for cheap dental implants in Hungary or Turkey.

Payment Options for Dental Treatment

Before proceeding with the costs for dental implants or any other dental treatment, your dentist should clearly explain all options and associated fees in a transparent way. If paying the full amount upfront isn’t possible, and you prefer not to delay your treatment, paying in instalments may be a suitable solution for you.

At Dentaprime, you can benefit from full-mouth restoration packages with dental implants that are up to 70% more affordable than the UK average. To make treatment even more accessible, we offer flexible financing options, including:

Dental Payment Plans

Our dental payment plans allow you to spread the cost of your treatment into manageable monthly payments. This option is arranged with the help of your Treatment Coordinator at the clinic.

- 20% down payment is required when signing the agreement and booking your treatment dates.

- The remaining 80% can be financed over a period of 1.5 to 10 years, depending on your preference and eligibility.

- A fixed interest rate of 4.99% applies for the financing term.

- You can repay your plan early at any time without any penalties.

This flexible payment structure allows you to start your smile transformation sooner — without financial stress.

What is a credit score and how to improve it?

To begin the approval procedure, you will have to claim a full credit report from a trusted provider in the UK – Experian.

Note: You can take advantage of the If you have a Good, Very Good or Excellent credit score, you could take advantage of our convenient instalments.

If your credit score is below the bare minimum here you can find practical advice on how to improve it.

Dental Payment Plans in Stages

Dental implant treatments are typically completed in two or three stages, depending on the complexity and amount of work required. Each stage is usually separated by a healing period of 3 to 9 months.

This payment approach is also known in the UK as the “Pay-As-You-Go” option. It allows you to pay for each stage separately, rather than covering the full treatment cost upfront.

- To secure your treatment dates, you can pay a £299 deposit when signing the agreement and booking your appointments.

- Alternatively, you can choose to pay 50% of the stage cost instead of the £299 deposit.

- The full amount for each stage must be settled at least one week before the first appointment of that stage.

Other payment options for dental implant treatment

Dental credit cards

Currently, in the UK there are no options for a dental credit card specifically, however you can have a credit card that you use for dental purposes only.

Generally, credit cards can offer various benefits like collecting airline points. They also offer extra security and assistance from your bank if the things you bought don’t work out as expected. Another important thing to highlight is that back in 2006 the European Union ruled against dentists’ extra charges for credit card payments. However, since the UK is no longer in the EU, there is a significant risk that those supplementary fees may come back again.

Personal dental loans in the UK

Unfortunately, not all dental practices can offer flexible payment monthly options to pay for your dental implant treatment. This is why as an alternative solution you may want to opt for a personal dental loan. If we could permit ourselves the liberty of giving direct advice – this is the least favourable option, especially in terms of convenience.

Still, if you’re looking for finance for dental implants, loans offer the following perks :

- You can select your provider

- There are more special deals available

- Flexible repayment options

Why get a loan instead of remaining toothless

Missing teeth can affect your speech, and comfort and limit food choices. Therefore if chewing is painful you inevitably change the side of your mouth that you use for eating. As a result, the jaw and facial muscles are distorted and since bone loss develops fast, missing teeth changes your appearance drastically.

According to research, tooth loss can have an impact on your overall health in numerous ways:

- Reduced fibre intake, which has a detrimental effect on the gut microbiome (because you consume fewer fruits and vegetables)

- Excessive intake of saturated fats – they leading to obesity, and an increased risk of heart disease

- Elevated rates of cancer and ulcers

- Increased risk of hypertension

Bringing it all together

If I have to distinguish one top perk of opting for private dentistry, that would probably be the reduced waiting time (as opposed to the NHS), and the fact that you have tremendous flexibility when it comes to choosing an appointment to fit your schedule. Given that we live in the age of technology and information that is available one click away, you can easily shop around and pick a dental practice of your choice that fits your budget and dental treatment of choice.

If we talk about dental implant costs in the UK – let’s face it – the extortionate prices for dental implants are one of the main reasons why Brits choose to venture abroad to look for cheap teeth with dental implants.

Thankfully, you no longer need to travel abroad to be able to afford them. Many practices offer flexible payment options if you’re not able to pay for your dental implant treatment in full. After checking your credit score, you could pay in monthly instalments or pay in stages before each following treatment.

Whichever option you choose – don’t lose hope and settle for removable dentures or worse- decide to stay toothless. This has detrimental effects on your overall health and harms your overall quality of life. Take charge today and claim your smile back!